Business Insurance in and around Woodburn

One of Woodburn’s top choices for small business insurance.

Insure your business, intentionally

Your Search For Outstanding Small Business Insurance Ends Now.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected mishap or damage. And you also want to care for any staff and customers who get hurt on your property.

One of Woodburn’s top choices for small business insurance.

Insure your business, intentionally

Protect Your Business With State Farm

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like business continuity plans or errors and omissions liability, that can be created to develop a customized policy to fit your small business's needs. And when the unexpected does occur, agent Justin Stearns can also help you file your claim.

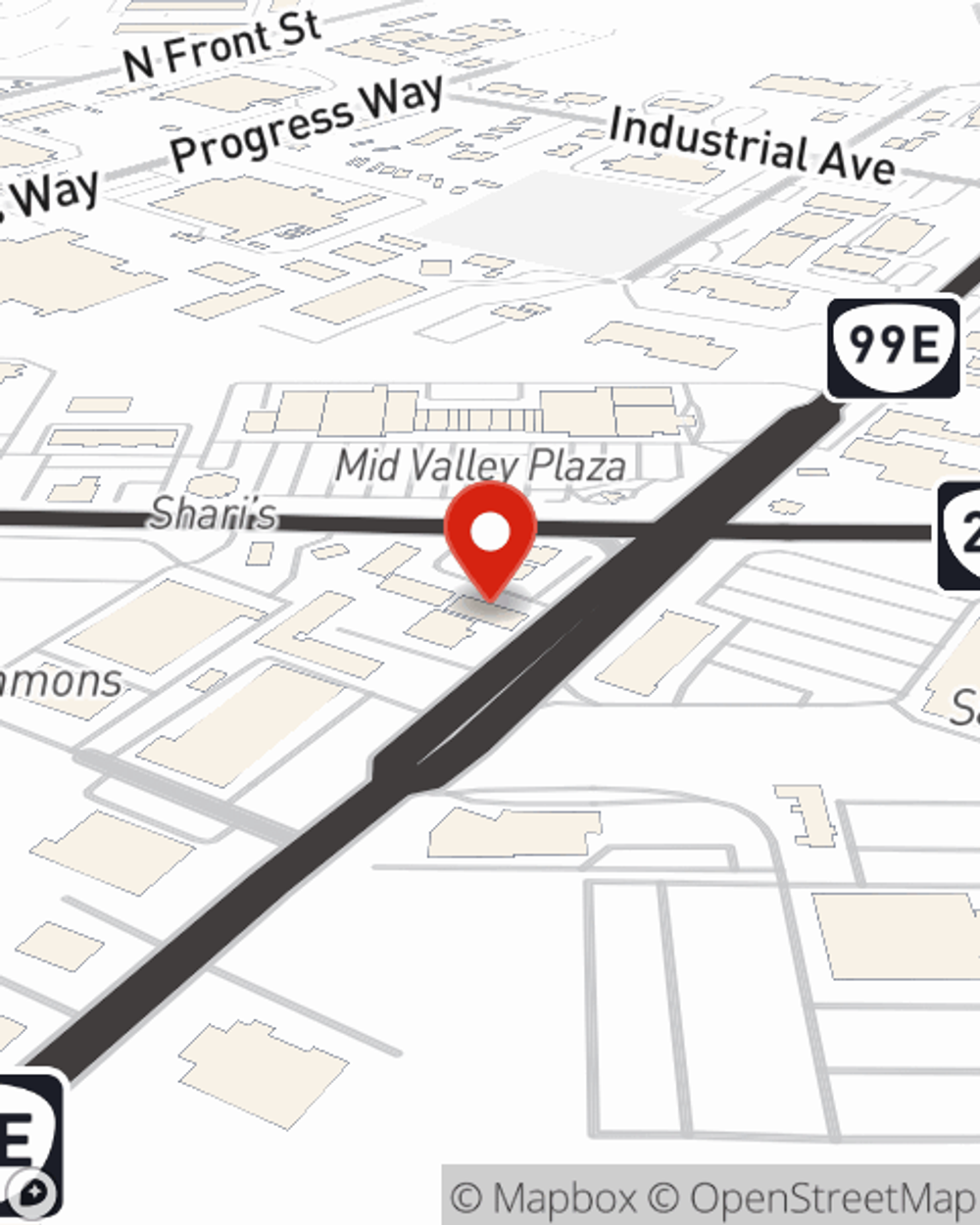

Don’t let concerns about your business stress you out! Visit State Farm agent Justin Stearns today, and see the advantages of State Farm small business insurance.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Justin Stearns

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.